tax return unemployment covid

Ad IRS Tax Forms Catalog more Fillable Forms Register and Subscribe Now. Of course you could also wait until you file your taxes and pay any tax you owe at that time.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

You can choose to have federal income taxes withheld from your unemployment compensation when you apply for unemployment benefits or you can choose not to do so and just pay estimated taxes each quarter to avoid a tax bill when you file your return.

. The Coronavirus Aid Relief and Economic Security Act CARES was enacted to alleviate the economic fallout of COVID-19. The COVID-19 pandemic caused many businesses to shut down leaving millions of taxpayers out of work. Lawmakers fixed this problem in the year-end Covid relief act.

Input claimant phone number. COVID Tax Tip 2021-46 April 8 2021. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax.

Come tax time taxpayers who benefitted from unemployment benefits in the past year will receive Form 1099-G from their state unemployment division. People who become unemployed for the first time are often shocked to learn that they must report their unemployment benefits more than 10200 on their 2020 tax return. Find COVID-19 Vaccine Locations With Vaccinesgov.

The IRS increased the standard deduction for tax year 2021 filings to keep up with inflation. The Standard Deduction. Ad Finding a tax return consultant in your area is easy with Bark.

COVID-19 Unemployment Benefits. Contact your states unemployment insurance program for the most up-to-date information. Vaccinesgov makes it easy.

HARTFORD -- State employers added 1600 jobs in April as the unemployment rate dropped to 44 last month. This is a federal tax break and may not apply to state tax. New to Texas Educating Adults Management System.

The Division of Unemployment Insurance DUI will calculate tax rates for contributory employers based on their pre-pandemic experience using the computation date July 1 2019 and using the normal computation date. This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return filed quickly accurately and on-time. Normally any unemployment compensation someone receives is taxable.

The state has now regained 237500 of the record 289400 jobs lost in March and April. You should receive a Form 1099-G showing total unemployment compensation paid to you in 2020. Unemployment benefits tax break.

Unemployment numbers surged at. Under normal circumstances receiving unemployment would result in a reduction of both credits when you file your tax return. Married couples can now take 25100 instead of 24800 last year and 1350.

A final stimulus bill was signed into law on March 11 and includes less money for weekly unemployment benefits but a bigger tax benefit. COVID-19 extended unemployment benefits from the federal government have ended. If you applied for unemployment benefits the CARES Act allows for 13 additional weeks of benefits until December 26 plus an extra 600 a week.

Ad Well Help You Get the Biggest Refund the Fastest Way Possible. This form outlines the total unemployment compensation received for the given tax year. COVID Tax Tip 2021-87 June 17 2021.

You may have to pay taxes on unemployment. The break applies this tax. Sorry Although this was waived for 2020 thanks to the American Rescue Planno taxes needed to be paid that year on unemployment benefits of up to.

100s of Top Rated Local Professionals Waiting to Help You Today. Return to Top Using Unemployment Tax Services You canLogon Need help. IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May.

The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in. Potential Unemployment Insurance Inquiries related to CoronavirusCOVID-19 calling TWCs Tele-Center at 800-939-6631 from 8 a. The newest COVID-19 relief bill the American Rescue Plan Act of 2021 waives federal taxes on up to 10200 of unemployment benefits an individual received in 2020.

Youre eligible for the IRS tax refund if your household earned less than 150000 last year regardless of. That number can be as much as 20400 for Married Filing Jointly taxpayers if each received benefits. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

HERES HOW THE 10200 UNEMPLOYMENT TAX BREAK IN BIDENS COVID RELIEF PLAN WORKS. When it comes to paying taxes on your unemployment benefits you have a few options. But you may still qualify for unemployment benefits from your state.

Unemployment benefits at tax time. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020.

The IRS will automatically refund. If you already have a User ID for another TWC Internet. Many taxpayers choose to voluntarily.

How To Claim Unemployment Benefits H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Is The Extra 600 Unemployment Check Weekly Your Money Questions Answered

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

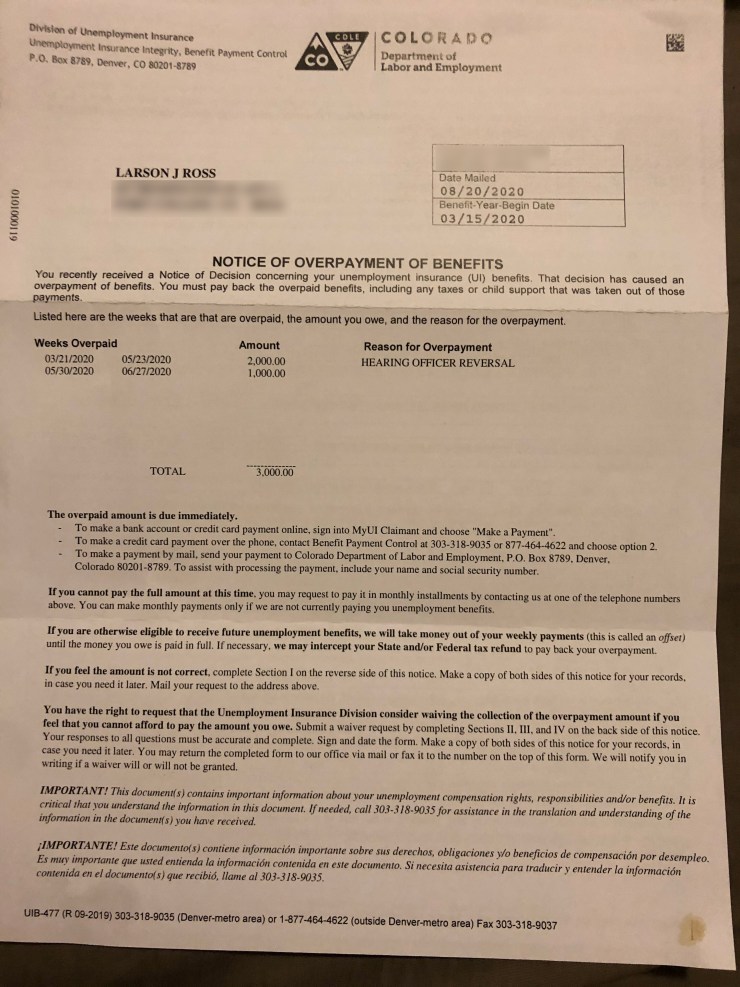

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Des Covid 19 Information For Individuals

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

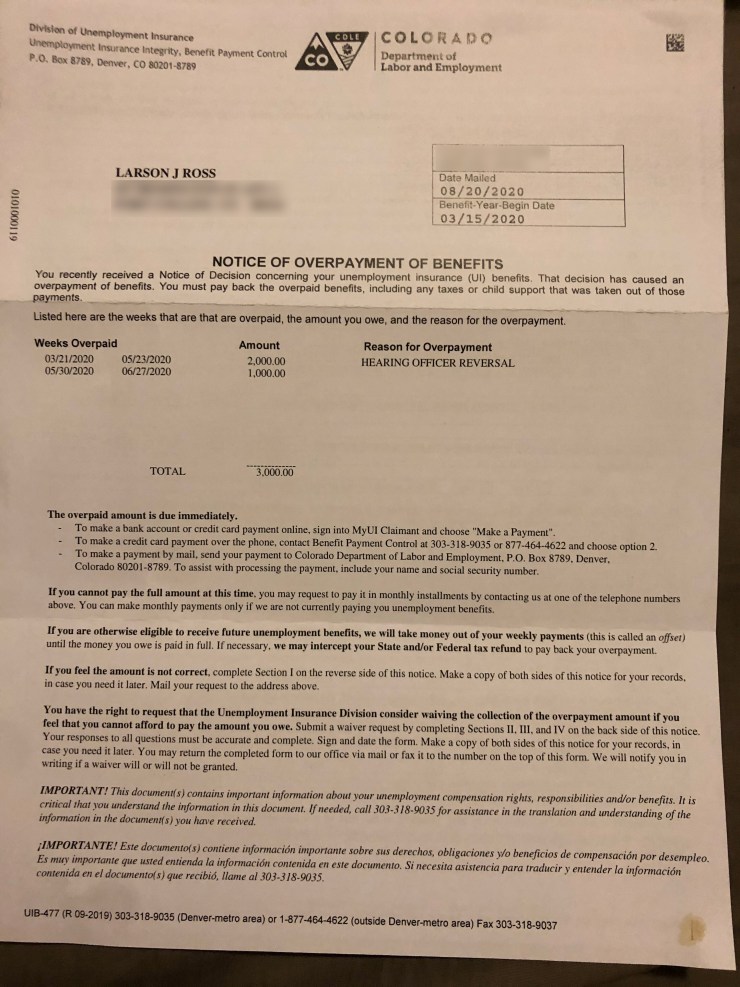

Covid 19 And Direct Payments To Individuals Summary Of The 2020 Recovery Rebates In The Cares Act As Circulated March 22 Everycrsreport Com

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

What To Keep In Mind About Your Unemployment Tax Refunds Wztv