trader tax status cpa

IRS Annual Filing Season Program Participant This individual is a. Preparation of a basic federal Form 1040 for each of the owners of the entity reflecting the flow-through from schedule K-1 is usually no more than 150 to 400.

Potential upsides of qualifying for trader status for tax purposes include.

. Taxpayers requiring more assistance in their tax and estate planning design and set-up of their trading business and with the preparation and review of their tax filings are encouraged to. Trader tax status is a special area in the tax law that provides for rules that allow a trader who meets defined criteria to treat the trading activity as a business. State and Local filings.

Get us on New York New Jersey let us help. Ordinarily people who invest. ATA CPA GROUP LLC has recently been awarded as one of the Top 50 Public Accounting Firms in New Jersey by NJBIZ We at ATA CPA Group LLC are a firm of Certified Public.

If this is your business feel free to claim this listing and update your profile information to bring the profile to live status. At Traders Accounting we specialize in offering a variety of tax preparation services specifically designed for active traders. Will need to apply for an accounting method change on IRS Form 3115 for the year the election is.

IRS Annual Filing Season Program Participant This individual is a. On the contrary you may be able to claim trader status and elect mark to market accounting with the IRS. Pro Trader Tax is a virtual tax advisory firm specializing in tax planning and counselling tax preparation entity formation and retirement plan services for active business.

If this is your business feel free to claim this listing and update your profile information to bring the profile to live status. If you qualify for trader status the IRS regards you as. CPA First has experienced international tax accountants quality tax lawyers who provide all kinds of international accounting tax services.

These services allow you to receive maximum benefits from the.

Traders Tax Pro Reviews Read Customer Service Reviews Of Traderstaxpro Com

Day Trading Taxes What New Investors Should Consider Turbotax Tax Tips Videos

Green S 2017 Trader Tax Guide Pdf Document

Forex Tax Tips Traders Tax Prep The Funded Trader Build Your Kingdom

Pro Trader Tax The Authority For Professional Traders

Small Trading Business Archives Locke In Your Success

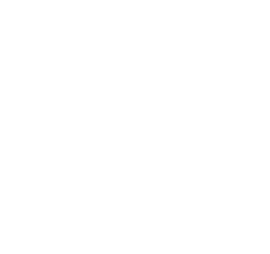

Day Trading Rules That Every Trader Should Be Aware Of

When You Should Hire A Cpa Or Tax Pro Reviews By Wirecutter

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Tax Planning My Investing Club

Trader Tax Corner Trader Tax Cpa Llc

Top 5 Questions Day Traders Ask

Trader Tax Corner Trader Tax Cpa Llc

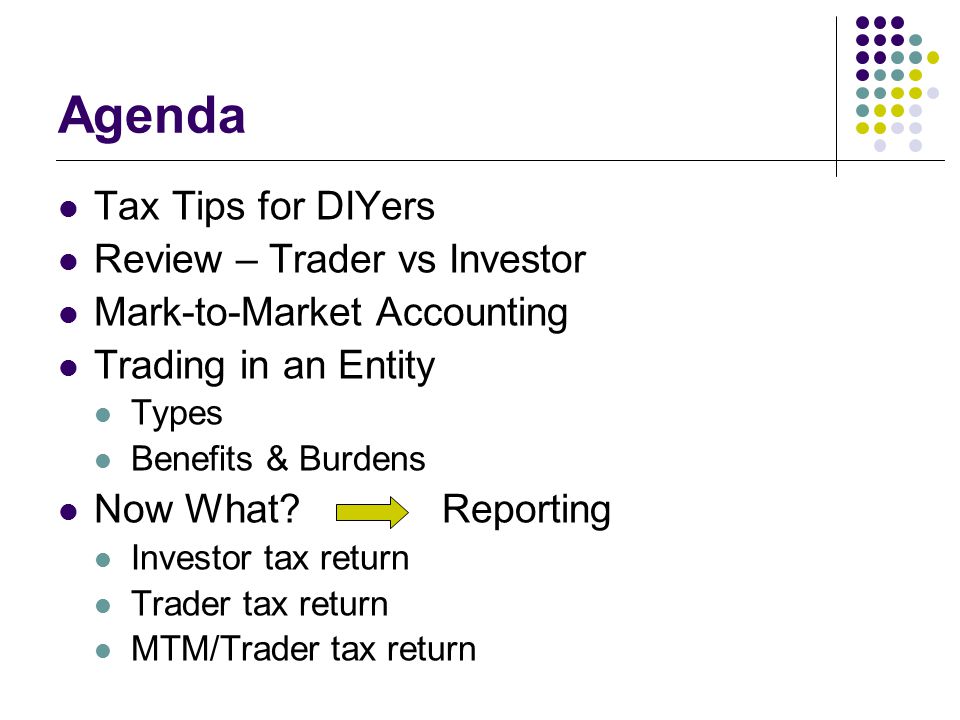

Trader Tax Management Optionsanimal Las Vegas Student Summit September 26 Ppt Download

Trader Tax Corner Trader Tax Cpa Llc

Lifo Vs Fifo Which Is Better For Day Traders Warrior Trading

Tax Impact Of Investor Vs Trader Status

Learn How To Qualify For Tax Favored Securities Trader Status Fust Charles Chambers Llp